5 Keys to Funding Your Technology Business Scale Up

Strategies for Funding a High Growth Technology Business

By Jeff Bardos, CEO, Speritas Capital

July 17, 2020 – Greenwich, Connecticut

Call or text Jeff at 203-247-4358

Schedule a Call

Email Jeff

I recently had the privilege of being a panelist at a Connecticut Technology Council event focused on scale ups. The discussion concentrated on capital strategies for scaling a tech business.

Growing revenue from $2-3MM to $30MM can be more dangerous for entrepreneurs than the start-up phase.

You have more personal wealth at stake, more investors and more staff counting on the company succeeding. You need to be educated, prepared and flexible.

Below are some of my thoughts for strategically funding the scaling of a technology business.

So How do you Prepare for Scale Up Financing in Tech?

I recommend 5 key strategies:

Sync up business and financing plans

Assess all financing options

Invest in cash management

Staff strategically

Find state & local resources

1. Make Sure your Business and Financing Plans for your Technology Business are in Sync

I’ve seen many tech companies focus solely on their business strategy and expect the financing strategy to somehow fall in line. This doesn’t happen by itself!

Equity, debt, cash flow loans and asset-backed lending each pair best with specific business strategies and balance sheet structures. Tech company CFOs and CEOs must plan ahead.

At a minimum, businesses should review their business and financing strategies on an annual basis.

Financing strategies should also be reviewed whenever a new product or service is being developed and whenever rapid expansion is expected.

In the tech space, purchase order finance can be a useful financing approach for fulfilling large orders which require either resold goods or goods which need to be assembled.

Contract financing related to monthly recurring revenues could also be an option for the scale-up stage.

2. Continue to Assess ALL your Financing Options

Technology businesses shouldn’t focus entirely on dilutive equity or mezzanine/venture debt.

These capital sources can be the right option, but consider whether you can stretch your equity and postpone or avoid dilution by using asset-backed finance.

Tech entrepreneurs tend to focus on equity rounds and venture debt but fail to look more broadly.

Keep in mind that your financing options change as your business evolves so options you may have discounted earlier could become relevant later on.

3. Invest in Cash Management

Investors and lenders need comfort that you know where your cash is and that you maintain a detailed cash forecast as part of your financial reporting process. (And when I say ‘need’ I mean will insist on.)

You should know who owes you money, who’s late and what terms you’ve agreed with each customer and with each vendor, and be able to produce reports upon request.

Like most entrepreneurs, technology business founders tend to focus on product development, marketing and distribution. The fun stuff.

They underinvest in their finance functions, assuming they can grow into those functions, hire staff and build them out later. But when they turn to the debt markets they have problems supporting their historical numbers and their projections.

Don’t be that tech founder!

Questions? Schedule a call with the author Jeff Bardos, email, or call/text him at 203-247-4358.

4. Hire the Right Staff at the Right Time

The balance between minimizing your burn rate and staffing up to meet increasing demands is one of the toughest balancing acts around for all high growth companies, not just tech businesses.

Make sure you have the right product, operational and financial talent - and a hiring plan that supports your business plan.

5. Seek Out State and Local Tech Support Resources

Most states and many cities have operational and financial support programs focused on the technology space, like the CT Technology Council.

These programs are designed to encourage employment and come in the form of grants, low-interest loans, free consulting and peer-to-peer networking groups.

You can find more CT Resources here (and easily find other state resources by searching the web.)

As debt advisors, Speritas Capital focuses on strategies #1 and #2 - making sure your business and finance plans are in sync and assessing financing options.

Then we look to see that you have established good cash management capabilities *#3) and that you’ve made strategic finance staff decisions (#4).

So get your ducks in a row now so that you are ‘debt ready’ when the need arises and have funding options beyond those that dilute your equity.

We’re here to help our clients assess their financing options at every stage of growth and we excel with complicated situations and structures.

Schedule a call with the author Jeff Bardos, or call/text him at 203-247-4358.

Additional Related Reading:

Read more about all your Asset Based Financing options.

Read the Pros and Cons of Accounts Receivable Financing

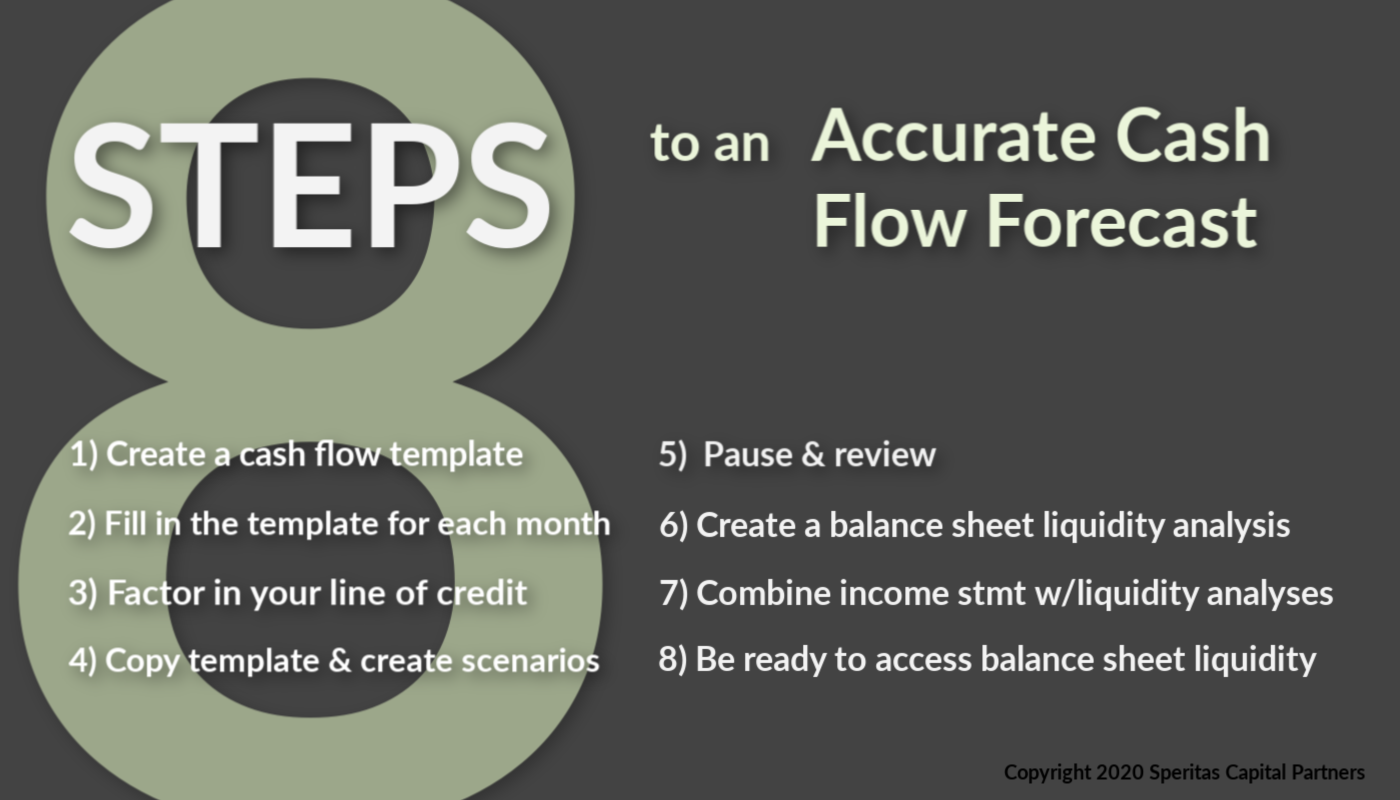

Read 8 Steps to an Accurate Cash Flow Statement (with template).

About the Author

Jeff Bardos, CEO, Speritas Capital Partners

Jeff has over 30 years of experience in the financial services industry. After graduating from the Columbia Business School, he joined the New York Federal Reserve Bank as a senior staff member in Bank Supervision, leading the Bank Analysis department. From the nation’s central bank, Jeff moved into the private sector, working at senior levels in commercial banking, retail banking and risk management. He has also played senior founding roles in several start-ups. Learn more about Jeff.

CONTACT INFO

Jeffrey Bardos

CEO Speritas Capital Partners

Call/text Jeff at 203-247-4358

Email Jeff with your technology business financing questions

Schedule a call with Jeff using our online scheduling tool.

Speritas Capital Partners specializes in complex credit, collateral and cash flow situations and we never take upfront fees.

Because Speritas Capital is a debt advisory firm, we have access to a wide variety of asset-based lending structures. We’re not beholden to any one lender or structure so we can use our creativity and experience to design a structure that truly fits the needs of our clients.