Articles by Speritas Capital

Loan Covenants Explained: How to Review & Negotiate Covenants to Avoid Covenant Breaches

You need funding that helps, not hurts, your business. Here’s how to review and negotiate your loan covenants before you sign.

How to Craft a Perfect Loan Pitch in 13 Steps

For lender discussions we advise our clients to focus on the "3 P's" of the loan pitch process - Prepare, Package and Present.

Asset Based Lending for Beginners

If you’re growing fast and lack of cash is hurting your business, consider asset based lending. Here’s a beginner’s guide to the pros and cons of ABL.

How to Start a Craft Brewery or Microbrewery: 9 Things to Consider First

Are you REALLY ready to start a Craft Brewery? Consider these 9 critical steps, and avoid costly mistakes.

When Your Bank Says No - Five Benefits of Working with Nontraditional Nonbank Lenders vs. Bank Lenders

If you are a high growth business and were recently turned down for a loan by your bank, here’s why an alternative lender or nonbank lender would fund your growth.

5 Keys to Funding Your Technology Business Scale Up

So how does a technology business prepare for scale up financing? Here are 5 key strategies for strong and controlled growth.

How To Choose a Commercial Loan Broker You Can Trust

Finding the right lenders for your financing needs takes a lot of time and effort. That’s why many businesses consult a commercial loan broker to find funding.

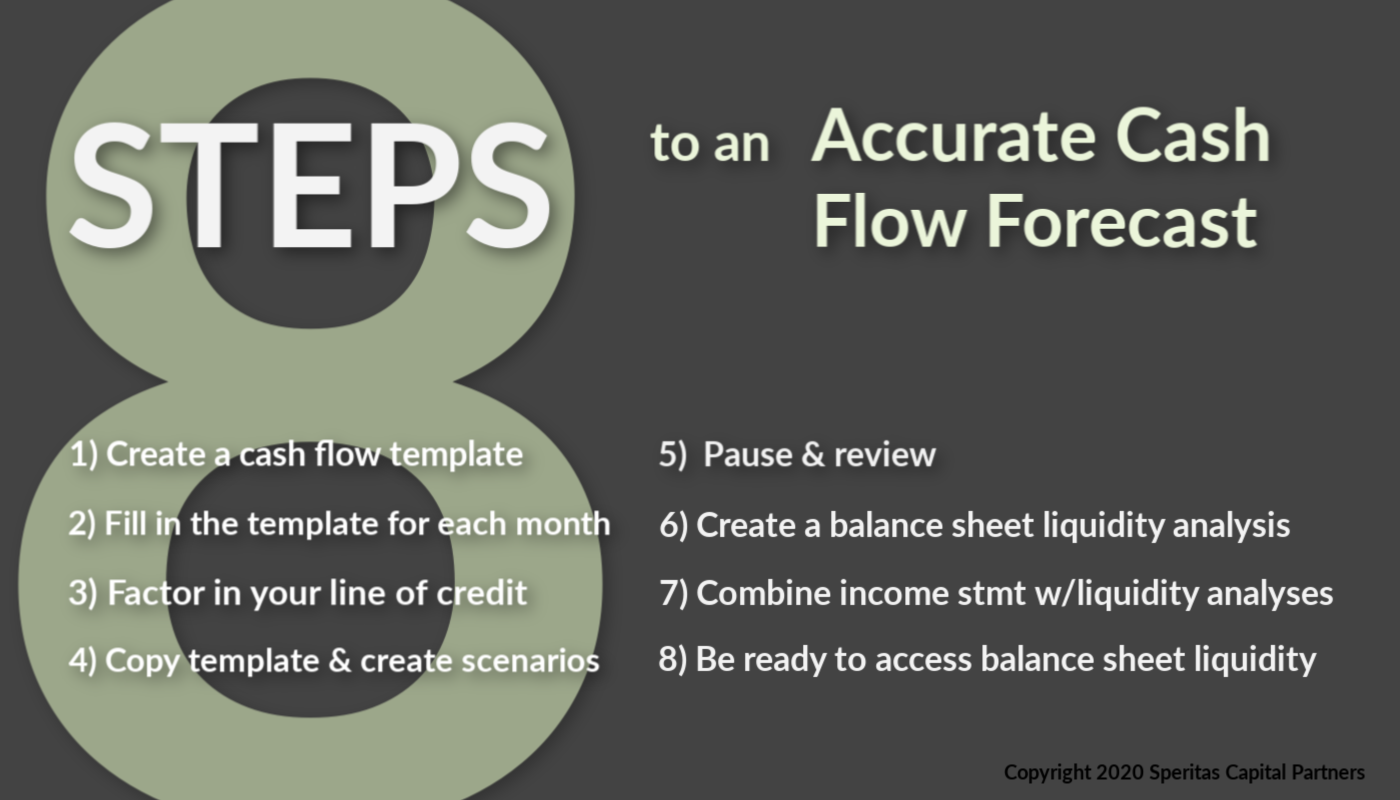

How to Manage your Liquidity: 8 Steps to an Accurate Cash Flow Forecast, with Template

How can strong liquidity forecasting and liquidity contingency planning help your business survive? Creating a cash flow forecast is critical for lenders, AND helps you plan for liquidity events.

The Pros and Cons of Accounts Receivable Financing

There are many advantages to using Accounts Receivable financing to fund your company’s growth, but there are also some perceived cons. Let’s dig in!

Four Reasons Small Businesses are Important to the Local Economy

Big businesses may seem to form the bedrock of the US economy and wealth creation, but in reality small businesses are more important to the ‘very’ local economy.

What is a Sources and Uses Table in Commercial Lending & Why do you Need One?

When you’re acquiring a business or purchasing commercial real estate, a sources & uses table helps you organize all the cash inflows & outflows. Lenders (including the SBA) expect to see this.