Asset Based Lending for Beginners

Asset Based Lending Explained: A Beginners Guide

By Jeff Bardos, CEO, Speritas Capital Partners

September 20, 2020 – Greenwich, Connecticut

Call or text Jeff at 203-247-4358

Schedule a Call

Email Jeff

Picture this scenario, it’s one I come across a lot….

Your business is having a hard time effectively managing cash flow and generating the funds you need to facilitate growth.

Your available funds are being drained as increased sales tie-up your cash in higher receivables. You’ve invested your cash in additional inventory and used it to grow your staff. You’re trapped in a catch 22.

Now what?

Growing companies can often become cash strapped. This is where Asset Based Lending (ABL) comes into play.

ABL has become an increasingly popular solution to the growing pains of a rising business.

Here’s how ABL works…

What is Asset Based Lending?

Asset based lending gives you access to funds in the form of a loan or line of credit secured by your assets.

As a secured loan, asset based lending is easier to secure than traditional bank financing.

Assets used for as collateral for ABL may include:

Receivables

Inventory

Property

Accounts receivable are more commonly used as security than other assets because their value is easier to measure.

Accounts receivable invoices are easily measured by invoice value for your creditworthy commercial customers. This asset type provides a larger percentage of value available to you as a line.

Asset based loans based on accounts receivable may go as high as 80 to 85 percent of invoice value.

By contrast, inventory may provide as low as 50 percent of its value available to you as a line.

The values of both inventory and property as collateral are hampered by risk of illiquidity.

Pros and Cons of ABL

Asset Based Lending Advantages

Provides a quick fix for cash flow

Is easier to get than conventional financing

Can be less expensive than factoring or other solutions

Asset Based Lending Disadvantages

Larger lines have more stringent requirements, including audits

Payment is made by customers to a lockbox, which may be confusing.

Invoices may be have to be verified, adding administrative overhead

Receivables must be from credit worthy customers

Questions? Schedule a call with the author now

How does Asset Based Lending Work?

Asset-based lending transactions usually take the form of a revolving line of credit.

The amount for which your company will be eligible is based on the value and type of asset that secures the loan.

Accounts receivable is the most commonly used asset to secure an asset based loan.

The selected assets become the base for the loan and the financing request is sent to the lender. Upon approval, funds are sent to your business bank account.

The asset-based loan transactions settle when the assets converted to cash.

In the case of accounts receivable, this is when the customers make their invoice payment to the lockbox or remit payment electronically to a special account.

What are the Fees for ABL?

If the underlying assets are receivables, which are most commonly used, there are usually two fees.

The discount fee is based on the gross value of the invoice batch you submitted for financing. This is a one-time fee.

The service fee works more like interest on a standard loan. A percentage of the funds you’ve utilized from your line is charged monthly, but calculated on a daily basis.

Some lenders may also charge audit fees, management fees, or other miscellaneous fees. The largest fee expense will be from the discount fee and the service fee.

Is ABL Right for Your Business?

Asset based Lending can provide a quick cash infusion when needed, and smooth the business cash flow highs and lows on an ongoing basis.

For companies that have assets, particularly those with receivables from creditworthy commercial customers, asset based lending has become an effective way to manage cash flow and continue to grow their businesses.

Every asset based lending situation is different. Schedule a call with the author, Jeff Bardos, if you’d like to discuss your business and how asset based lending could help manage your growth and cash flow.

Schedule a call with Jeff Bardos, email, or call/text him at 203-247-4358.

Additional Related Reading:

Read more about all your Asset Based Financing options.

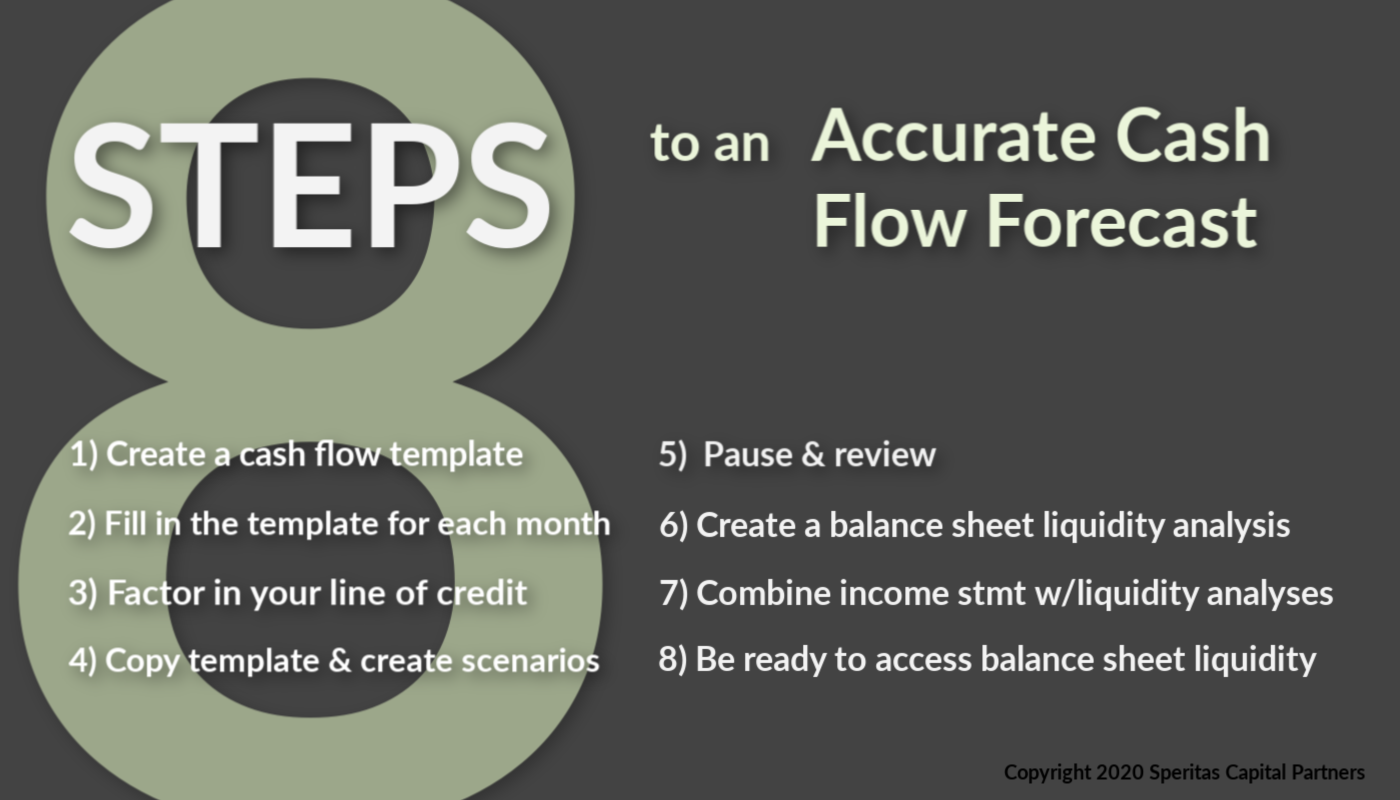

Read 8 Steps to an Accurate Cash Flow Statement (with template).

About the Author

Jeff Bardos, CEO, Speritas Capital Partners

Jeff has over 30 years of experience in the financial services industry. After graduating from the Columbia Business School, he joined the New York Federal Reserve Bank as a senior staff member in Bank Supervision, leading the Bank Analysis department. From the nation’s central bank, Jeff moved into the private sector, working at senior levels in commercial banking, retail banking and risk management. He has also played senior founding roles in several start-ups. Learn more about Jeff.

CONTACT INFO

Jeffrey Bardos

CEO Speritas Capital Partners

Call/text Jeff at 203-247-4358

Email Jeff with your asset based financing questions

Schedule a call with Jeff using our online scheduling tool.

Speritas Capital Partners specializes in complex credit, collateral and cash flow situations and we never take upfront fees.

Because Speritas Capital is a debt advisory firm, we have access to a wide variety of asset-based lending structures. We’re not beholden to any one lender or structure so we can use our creativity and experience to design a structure that truly fits the needs of our clients.